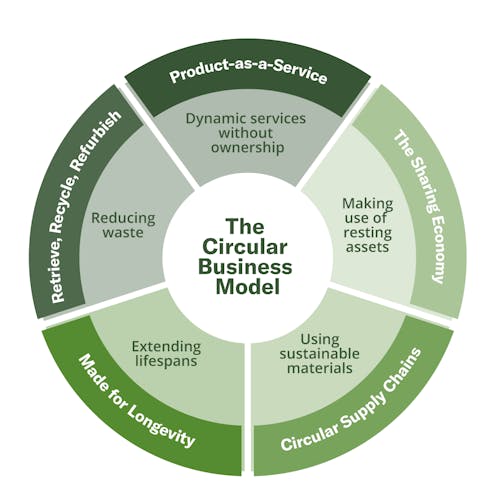

Pillar 3: Sustainability

Satisfying emerging business models, driven by net zero and ESG regulation.

Founded on six pillars, Alfa Systems 6 helps finance providers tackle the significant challenges they face, and seize the lucrative opportunities that lie waiting.

Why Sustainability?

The asset finance industry is undertaking a period of exciting change, driven by environmental concerns and regulations. In 2023, Alfa announced new Scope 3 reporting functionality to help its customers track and report their portfolios' Scope 3 greenhouse gas (GHG) emissions. Now in 2024, Alfa Systems 6 helps you achieve the flexibility required to navigate this journey completely.

With corporations compelled to prioritise their emissions and comply with other environmental imperatives, they are required not only to transform their own business models, but also to influence those of their supply chains.

Although the direction of travel is certain, the route is far from known. Flexibility is therefore crucial for both finance companies and their customers. They need to be able to:

- Develop and finance new products, quickly

- Embrace emerging integrated technologies

- Explore fresh ideas, iterating and backtracking as necessary

As continually evolving technology that can be finely and efficiently tuned to meet your unique needs, Alfa Systems 6 helps you achieve such flexibility.

Introducing Sustainability

in Alfa Systems 6

Alfa takes great pride in its ESG credentials, as well as the diversity of its people and customer base.

Our teams work closely with our customers to understand their evolving needs around sustainable business models. This collaborative approach has led to the development of powerful solutions that meet their requirements emphatically.

Sustainability in Alfa Systems 6 is equipped to address your sustainability goals:

- New capabilities for managing the entire asset lifecycle, from origination to end-of-life

- Readily available to support subscription business

- Fully equipped to facilitate your XaaS offering

1. Enhanced Asset Lifecycle Management

Alfa is excited to announce new capabilities for managing the entire asset lifecycle, from origination to end-of-life.

Equipment providers globally are asking themselves the same question: How can we prolong the lifespan of our existing products, and identify new markets for their continued use?

To address this, their captive finance companies are moving away from the traditional ‘lease-and-sell’ model, instead establishing teams and processes dedicated to asset management across the lifecycle, maximising inventory use and profit.

Assets returning from an initial lease can be maintained in inventory for subsequent use, refurbished, or broken down into sub-assets for recycling. Regardless of the equipment's journey, finance companies need to track and account for all assets, meticulously - both on- and off-lease. This signifies a shift from focusing solely on the contract, to prioritising the asset itself.

To meet these requirements, Alfa is excited to announce new capabilities in Alfa Systems 6 for managing the entire asset lifecycle, from origination to end-of-life. This includes:

- Inventory management for reuse and resting

- Short-term second and third lives for equipment

- Streamlined refurbishment processes to extend product lifespans

2. Subscription-Ready Platform

Through strategic product investment, Alfa Systems 6 is readily available to support subscription business.

In order to provide customers with access to cutting-edge technologies at competitive rates, asset finance companies are teaming up with captives, as well as other equipment and auto finance providers, to offer subscription services alongside traditional asset financing.

Alfa's experience with this combination has seen a range of services and models offered, which highlight the need for genuinely flexible solutions. This extends beyond basic features like heated seats; customers can choose from on-lease or off-lease subscriptions, with usage-based or periodic billing structures.

The technology extends to targeted software subscriptions that optimise equipment usage, or provide on-demand add-ons for additional power.

Across industries and markets, asset finance is being used to power a growing use of subscription-based sales models. Flexibility is becoming imperative as propensity for leasing and flexible ownership grows, either in the form of paying for transport on demand, bundled services in corporate fleets, or for functionality powered by new vehicle technologies.

Thanks to our strategic product investment over the last few years, Alfa delivers dependably on requests to support these new services. Capable of accommodating a usage-based service that extends beyond the end of its lease term, or a subscription covering an entire portfolio - charged periodically - Alfa Systems 6 is readily available to support your subscription business.

3. XaaS: Everything-as-a-Service

Alfa Systems 6 is fully equipped to facilitate your XaaS offering.

As interest rates have climbed and risk appetites fallen, particularly around commitments to emerging technologies, corporations are increasingly favouring OpEx projects over CapEx investments, and shifting towards XaaS models to procure equipment.

As mobility, construction, industrial and machinery companies are looking for ways to increase their ROI, they are moving away from buying machinery outright as ownership makes less commercial sense. Since value is no longer tied to ownership, OpEx models are adopted to unlock money formerly reserved for CapEx purchases. There is a greater propensity to choose leasing, machine subscriptions, pay-per-outcome, and equipment-as-a-service, such as batteries-as-a-service models.

XaaS can encompass short or long-term assets, supplementary services and usage-based charging. For finance companies and captives, this necessitates effective asset tracking - monitoring location, availability and usage - while incorporating the financing and invoicing of essential add-on services into a single, consolidated billing line.

Alfa Systems 6 is fully equipped to support XaaS:

- Multi-asset schedules and contracts

- Usage meters and customised usage-based billing

- Integrated seamlessly with configurable, consolidated billing

Use case: Green energy financing

The fight against greenhouse gas (GHG) emissions is leading to a fundamental shift in the demand and supply of greener energy. Traditionally, manufacturing companies relied solely on their energy suppliers, hoping they would provide energy from greener sources.

However, with a growing focus on reducing their own carbon footprints (Scope 1 emissions), manufacturers are now empowered to take control of their energy sources. This opens doors to exciting possibilities, including:

- On-site renewable energy generation: Companies can install solar panels and wind turbines, along with combined heat and power (CHP) engines. These systems can be leased from finance companies, alongside add-on services like insurance and maintenance, satisfying a meaningful proportion of their energy needs.

- Flexible purchasing: On-site generation might not meet all energy requirements, but manufacturers can still take top-up energy from their energy suppliers. Usage-based billing ensures they pay only for what they use, with a minimum monthly fee. Additionally, they have the flexibility to pool usage across multiple assets, receiving a single consolidated bill for convenience.

Alfa Systems 6 fully supports this new approach, empowering manufacturers to be more sustainable and efficient, contributing to a greener future for all.

Read more in our paper co-written with Capitas Finance, Towards energy resilience: closing the efficiency gap.

Use case: Electric vehicles

Alfa Systems 6 provides robust support for both simple and complex use cases in the financing of electric vehicles.

It accommodates multiple auto EV portfolios, employing versatile, multi-asset schedule support. Furthermore, Alfa Systems 6 establishes the framework to satisfy more complex user requirements.

Consider a farmer who leases multiple electric tractors, along with their batteries and chargers. In addition, she subscribes to:

- GPS services, to monitor her fleet's efficient usage

- A charging station, for affordable and rapid public charging

- (For some of her fleet) a usage-based 'Boost' service, for additional power when needed

During idle periods, our farmer connects her tractors back into the grid, contributing energy during peak times and replenishing during off-peak hours. This earns usage-based discounts on her energy bills, provided through a partnership with the finance company.

The result: one simple, consolidated monthly bill, leaving the farmer happy and focused on what matters most – running a sustainable and efficient farm.

Using Alfa Systems 6, our farmer’s finance company can support this set-up:

- Usage-Based and Asset-Level Financials products support boost and insurance services on the tractors and chargers.

- Direct Billing is used to charge for the GPS and charging subscriptions.

- Invoice cycling and Consolidated Billing features leave the end customer with a single monthly bill.

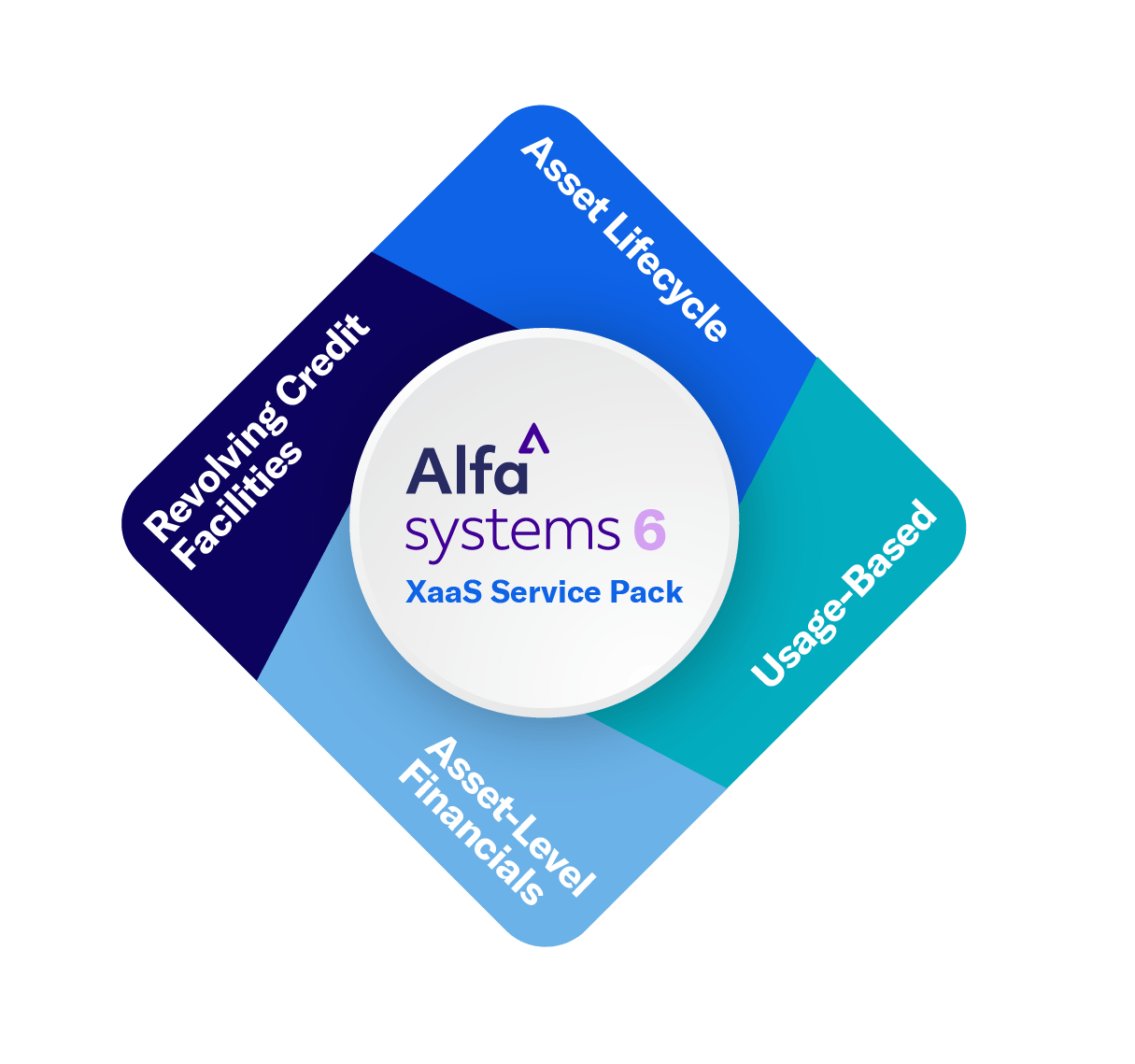

The Alfa Systems 6 Sustainability solution

Service Packs in Alfa Systems 6 deliver the functionality you need, when you need it.

Alfa Systems 6 provides the flexibility for you to tailor your solution with optional modules, addressing both your current and future needs.

To meet specific customer requirements, Alfa's product teams have designed Service Packs, containing specific modules that enable you to subscribe only to the functionality you need, when you need it.

XaaS Service Pack

- Asset Lifecycle

- Usage-Based

- Asset-Level Financials

- Revolving Credit Facilities

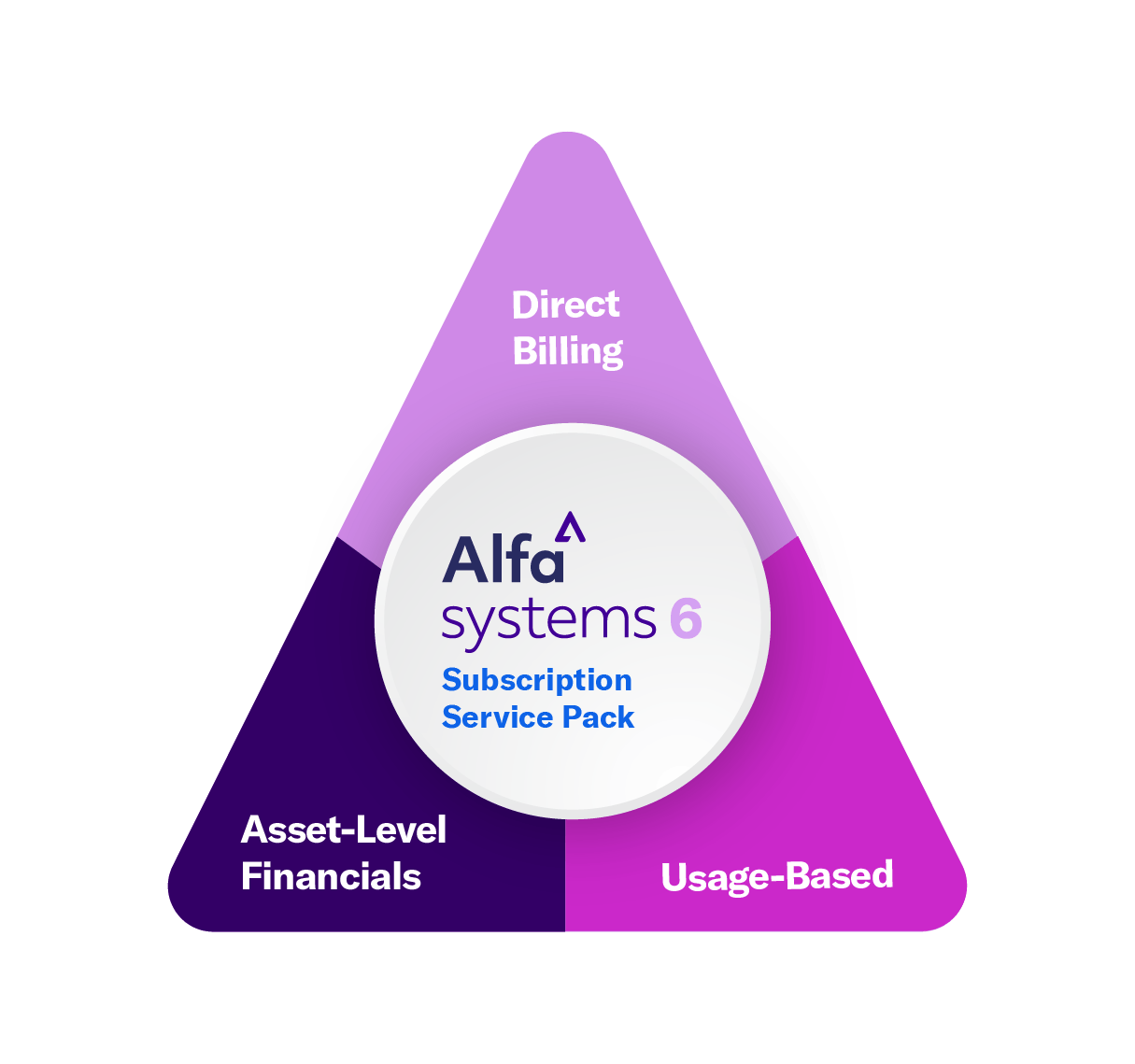

Subscription Service Pack

- Asset-Level Financials

- Direct Billing

- Usage-Based Products

Read the module documentation

Tailor your solution with optional modules, addressing both your current and future needs.

Scope 3 Emissions Reporting is a complementary component of core Alfa Systems and Alfa Systems 6 functionality.

Sustainability: Further enhanced in Alfa Systems 6

Meeting the future business needs of successful finance providers

Launched in September 2023, Alfa was the first provider of asset finance technology to incorporate a Scope 3 emissions calculator for leases and loans into our core product. Scope 3 Emissions Reporting allows a finance provider to report on a mixed portfolio of EVs, hybrids or ICE vehicles. Reporting is based on actual or estimated usage, utilising daily capital and interest balances. The data can be used to compare portfolios enabling strategic decision-making and satisfying reporting obligations.

Alfa Systems’ first EV portfolios were onboarded in 2020. The combination of multi-asset schedules, asset-level financials, usage-based billing and direct API integrations enables Alfa to provide unparalleled support to customers originating and servicing their EV portfolios. Through ongoing dialogues, user groups, and thought leadership initiatives, we continuously refine and enrich these capabilities, ensuring alignment with the evolving needs of some of the largest global auto finance providers.

Sustainability: Meeting challenge and opportunity

Alfa Systems 6 can transform your business, open up new revenue streams, and bring heightened productivity to your operation.

New regulations bring new opportunities. Equipment manufacturers are investing heavily in greener assets, while corporations require substantial infrastructure investments as they transition from traditional fossil fuel-based energy to renewables. For all these undertakings, financing is crucial. Finance companies must seize the potential of these emerging markets, by enhancing their technology and operational infrastructure to meet the new demands. Alfa Systems 6 can facilitate this journey by providing the necessary flexibility and functionality.

As companies vie for investment and prime resources, their ESG credentials emerge as a pivotal differentiating factor. Consequently, they are actively seeking novel approaches to finance, acquire, and utilise green and grey assets, which optimise their GHG (Greenhouse Gas) emissions across Scopes 1, 2, and 3. By doing so, they can facilitate a smooth transition to net zero and meet their financial targets. This quest for sustainability is driving innovation in both product offerings and business models. Alfa Systems 6 is designed by understanding the needs and pain points of finance companies. It equips users with the necessary tools to introduce flexibility into their business models, whether through new product ranges, asset reuse strategies, or the development of innovative XaaS solutions. Alfa Systems 6’s Scope 3 Emissions Reporting solution enables tracking of progress towards these end goals.

Finance companies and captives are seizing the opportunity presented by new assets to drive innovation and offer enticing add-on services to users. Many of these are being marketed through subscription models, granting customers the flexibility to explore new offerings and pay only for the amount or duration of usage. With Alfa Systems 6, finance companies can seamlessly integrate these services on- or off-contract, whether with fixed or scheduled charges, at flat rates or based on usage metrics. Real-time reporting capabilities allow them to assess the effectiveness of these products, and respond quickly to maximise profitable opportunities.

Amid escalating regulation and the uncertainty surrounding the timing, scope and even trajectory of future regulations, finance companies find themselves compelled to make risk-based decisions regarding their future processes and operating model. Alfa, supported by its dedicated Markets and Products team, diligently tracks impending regulatory shifts and integrates this knowledge into product development initiatives. This proactive approach has enabled the early adoption of a comprehensive Scope 3 Emissions Reporting solution, and has also streamlined business models to facilitate the transition towards achieving their net-zero goals.

Finance companies, corporations and consumers alike are navigating the delicate balance between the wish to be more ‘green’ and the associated cost constraints. With rising interest rates and inflation putting pressure on margins throughout the supply chain, tough decisions must be made. Alfa Start offers customers an accessible asset finance system that incorporates essential functionalities for establishing a sustainable asset finance business at an affordable cost. Its modular structure provides flexibility, allowing customers to incorporate various product types and use cases only when a return is guaranteed from this business model.