Commercial Finance

Comprehensive capability for the most complex commercial leases and loans.

Alfa has been empowering finance providers since 1990, with Alfa Systems established as an industry-leading SaaS solution. The variability and complexity associated with commercial loans and finance make Alfa Systems the ideal fit.

Access to commercial finance is essential to economic growth, and ensures that businesses of all sizes can expand without having to wait to accumulate sufficient cash for self-reinvestment.

However, the industry is facing several challenges, such as changing regulatory requirements, data security risks, and evolving customer needs. Alongside the ever-present need to manage costs and improve efficiency, commercial finance providers can benefit from an investment in reliable, adaptable, cloud-native technology that can streamline entire processes and bring heightened operational productivity.

Alfa has a truly unrivalled delivery record and decades of experience supporting complex loan and lease processes, in diverse global implementations with multiple product types. Alfa Systems offers commercial finance providers class-leading business process automation and expansive product support, with proven multicurrency capabilities, alongside real-time accuracy and compliance features.

For those undertaking a systems selection exercise, striking a balance between operational efficiency and richness of capability poses a challenge.

Consolidating your processes and business lines on a single platform like Alfa Systems offers the complete ensemble of cost savings, efficiency gains and rich functional depth.

Alfa Systems supports comprehensive variable rate and complex lending functionality, including:

- Risk-free rates, such as SONIA, money market and base rates

- Automatically processed interest rates, allowing capitalisation of interest into the balance

- Flexible interest rate calculation options, including those based on actual payments

- Differing rate periods, multiple margins and varying payment profiles

Furthermore, Alfa Systems’ comprehensive management of exposure and lines of credit includes:

- Automated underwriting for lines of credit

- Management of both revolving and liquidating credit lines

- Simple carve-outs of credit facilities from revolving to liquidating

- A comprehensive view of total exposure, including management of exposure in external systems

Commercial finance providers face a host of intricate business challenges and increasing regulatory complexity, which necessitates automation and agility around financial transactions and their traceability.

Alfa Systems equips its customers with robust functionality that empowers them to achieve that, including:

- Support for risk-free variable rates with automatic handling of non-working days, native support for lag/shift observations, and rate compounding within an interest period

- Full cash audit trail with real-time updates

- Real-time reporting through Alfa Systems’ Operational Data Store

- All underpinned by a detailed and transparent audit trail

For calculations traceability:

- Tracking of balances on credit facilities and utilisation of lines of credit over time

- Processing of backdated transactions with automatic recalculation of correct positions

- Automatic creation of documents displaying calculations

Read more in Accuracy and Compliance.

Alfa Systems provides unparallelled support in converting high-level business processes into configured workflows and business rules, minimising manual intervention, reducing operating costs and enabling better customer service.

Customers have the power to automate their processes to an extent that suits their business, including:

- Automatic processing of differing interest rate types and variable rollover periods within a contract

- Reschedule wizards for simple operations drawdown requests or prepayment processing

- Seamless handling of backdated allocations with automatic adjustments

- Document generation with detailed breakdowns of customer interest calculations, balances and charges

- Automated capitalisation of interest on contracts

- Flexible integrations with other systems for further automation and real-time reporting

Read more in Process Automation.

A multijurisdictional rollout of new software is a complex undertaking. Providers looking to expand within their current markets, or break into new regions and business lines, need to maintain high levels of flexibility while minimising capital expenditure.

At Alfa, one of our key strengths is understanding the unique challenges this entails. We are adept at minimising complexity and futureproofing your operations, equipping you with everything you need to achieve this - including:

- Multi-GAAP accounting capabilities, for global companies to be able to report over a single loan in multiple jurisdictions

- Support for global currencies in a single instance

- Management of multiple working day calendars in a single instance for facilities across different jurisdictions

- Extensive support for various accounting types, variable rates and interest calculation methods

Read more in Multicountry.

Making your systems talk to each other doesn't have to be a headache.

Based on industry-standard technologies and approaches, alongside decades of Alfa knowledge and expertise, Alfa Systems has been designed to enable our customers to source and integrate with new technologies painlessly, creating their own customised, end-to-end solutions.

Specialist commercial finance features include:

- Granular API for real-time exposure and cash view integration within your lending landscape

- Automated input, update and management of credit facilities and lines

- Automated payment processing in industry-standard formats

- Automatic generation of key action documents

Read more in Extensible Platform.

The Alfa Systems Commercial Finance solution

Alfa Systems is secure and cloud-native with AWS, while its extensible nature lets you extend and embed functionality throughout your systems landscape. Our business intelligence solution provides real-time data and insights, custom reports and pluggable data APIs. Meanwhile, Alfa iQ delivers artificial intelligence to your operation, with a mission to make access to finance efficient, intelligent and fair.

Alfa’s expertise in data migration is unparalleled, and we offer further professional services in the form of business process consultancy, technical architecture, application ownership consultancy, UI design, project management and training consultancy, tailored specifically to the commercial finance industry.

“Santander and Alfa worked in close partnership to deliver a highly successful system replacement programme to support Santander's corporate lending operations. The successful delivery of the project has enabled us to consolidate multiple portfolios onto a single system, delivering business benefit and providing a platform to enable future change”.

Introducing Revolving Credit: A New Module for Commercial Finance

Revolving Credit provides support for lending facilities that charge fees based on drawn and undrawn balances from underlying lines of credit and agreements. They feature a range of fee types and structures, including fixed- and tiered-rate utilisation fees, which can be varied based on drawn percentage, and incorporate fixed or scheduled admin payments.

Commercial finance providers can aggregate lines of credit and agreements together from single clients, and benefit from additional fees covering costs of committed lines of credit. Fee structures are flexible, allowing adjustment for various business lines and backdated events such as drawdowns.

Features you can expect from Alfa Systems' Revolving Credit Module:

Users can create and monitor a credit facility which is linked to one or more underlying lines of credit, and specify which underlying lines of credit should be included in the calculation of drawn and undrawn balances. Credit lines within a facility can be partly or fully converted from a revolving credit line to a term (liquidating) credit line.

Users can charge fixed fees on a credit facility. Charges can be one-off or recurring. This could be used for annual facility fees, drawdown fees or administrative fees. These are accounted for on a cash or accrual basis and can be tracked in the Alfa Systems UI and reported on through the Operational Data Store.

Users can charge fees on the utilisation (drawn portion) or non-utilisation (undrawn portion) of a credit facility. The fees can be based on a fixed or tiered rate, derived from a user-specified grid for a given utilisation percentage. These fees can be tracked in the Alfa Systems UI and reported on through the Operational Data Store.

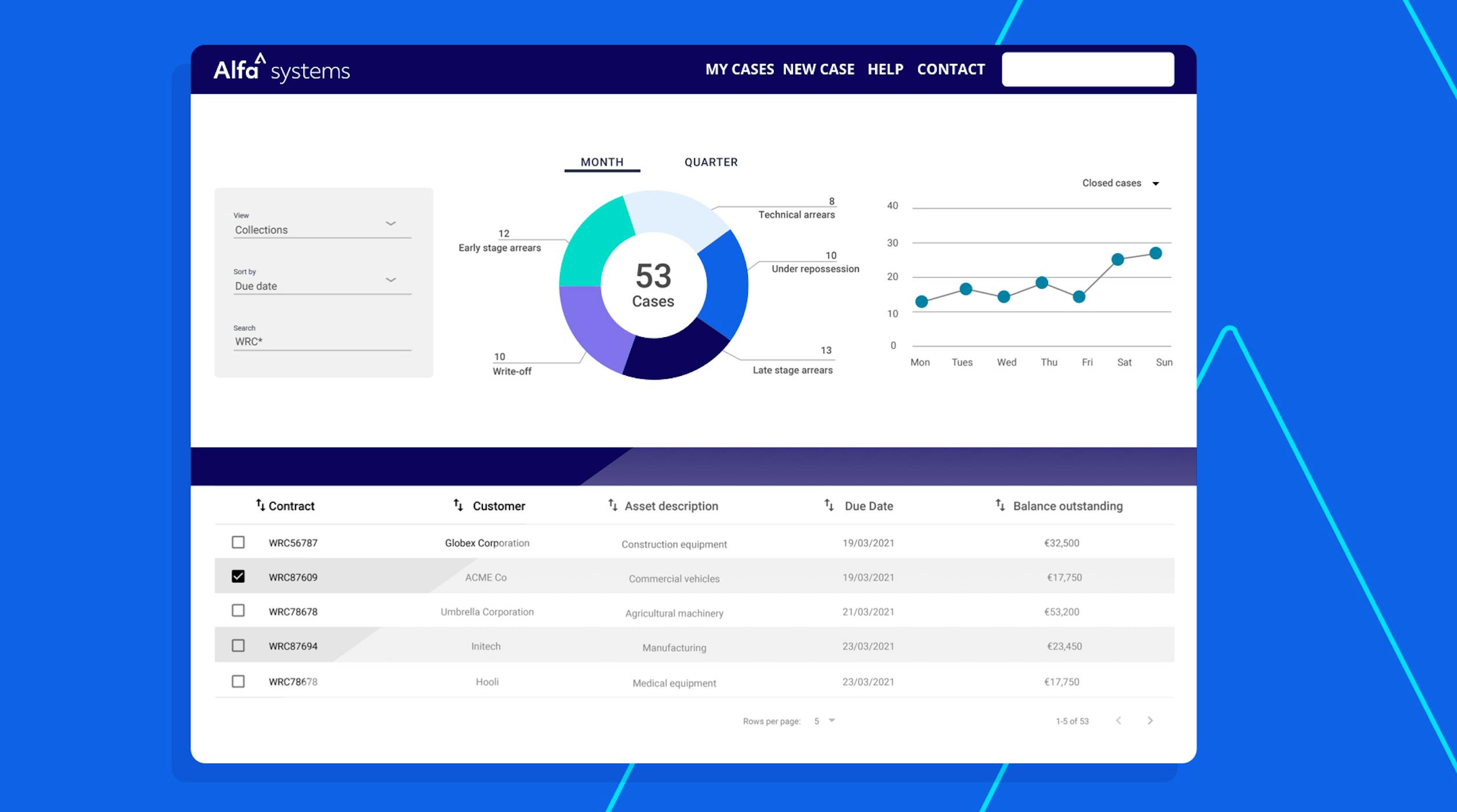

Collections users can set up automatic processes based on arrears on revolving credit facilities, which can be viewed distinctly at the third-party level.